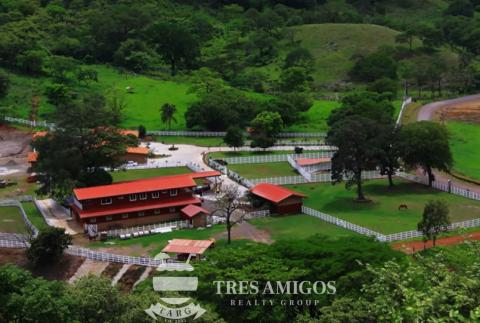

Welcome to Your Dream Property in Papagayo, Costa Rica

Expert Guidance to Help You Find Your Ideal Home, Condo, or Development Property

Thanks for visiting my website. My name is Alain and I love helping people to find that perfect place to live or invest in Costa Rica. I specialize in the renowned Papagayo region, a treasure trove of opportunity for those seeking to invest in a home, condo, residential building lot, or development property. With over 30 years of experience living and working in Costa Rica, I am ready to use my knowledge to help you navigate the real estate landscape and find the perfect property in Papagayo that meets your dreams and investment goals.

Discover the Papagayo Region: A Diverse Paradise

The Papagayo region is well known for its diverse array of properties, set against a backdrop of breathtaking natural beauty. Whether you're drawn to the vibrant life in Playas del Coco, the serene beaches of Playa Hermosa, the tranquil settings of Playa Panama and Playa Ocotal, or the untouched landscapes of Matapalo, Papagayo offers an unmatched variety of living experiences. Here, the perfect home, condo, or plot of land for your dream residence awaits.

Personalized Service from a Trusted Expert

As your dedicated realtor, I offer more than just access to premium homes and condos. My deep understanding of both the nuances of the Costa Rica real estate market and the specificities of the Papagayo region means I can provide tailored advice to secure your ideal property. Your needs are the most important thing to me. My goal will be to help you make an informed decision that meets your lifestyle and investment objectives.

Let Me Be Your Guide to Securing a Property in Papagayo

Finding the right property in Papagayo, whether it's a luxurious condo, a spacious home, or a prime piece of land for development, requires insight and expertise. With three decades of experience, I am well-equipped to guide you through every step of the process, from identifying the right property to navigating the legalities of purchasing real estate in Costa Rica. My commitment is to make your search for a Papagayo property as seamless and successful as possible.

Start Your Journey Today!

Begin your search for the perfect home in Papagayo. I will help you by combining local knowledge with a genuine passion for helping you find your perfect dream home or investment. Explore my website to learn more about what the Papagayo region has to offer, and when you're ready, reach out to me. Together, we'll turn your vision of owning a stunning property in Costa Rica into reality.